Black Friday – the day after the USA Thanksgiving holiday on the fourth Thursday of November – has been exported to the rest of the world as the premier shopping day of the year. In South Africa, we have caught the retail fever in a major way, but 2020 saw a big decline in this shopping day/week/month. We take a look at what it was last year and compare it with the possibilities of 2021.

Not surprisingly, Black Friday 2020 was dismal compared to 2019, with volumes down 33% and value down a whopping 52%, according to payment clearing house BankservAfrica. This drop was despite the low alert level between the second and third waves and could be attributed to both the anxiety around the pandemic and the massive economic contraction and job losses that resulted from it.

2021 promises to be better than 2020, but not as good as 2019 and before. The shopping patterns too have changed, with the traditional overnight storefront camping fading (10 big-screen TVs at R100) to more sensible value for money offerings in all categories from luxury electronics and white goods to fashion and household and food essentials.

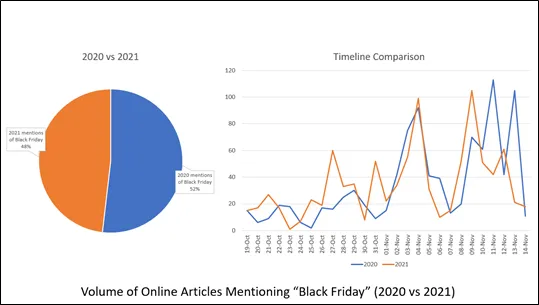

An analysis of the percentage of articles between 19 October and 14 November in ’20 and ’21 around Black Friday (52% vs 48%) shows very much the same pattern, but this year peaking earlier and ’20 showing a big shout for attention last year toward the middle of November. This most likely represents retailers realising their predicament as the big day approached last year and boosting their PR efforts in return.

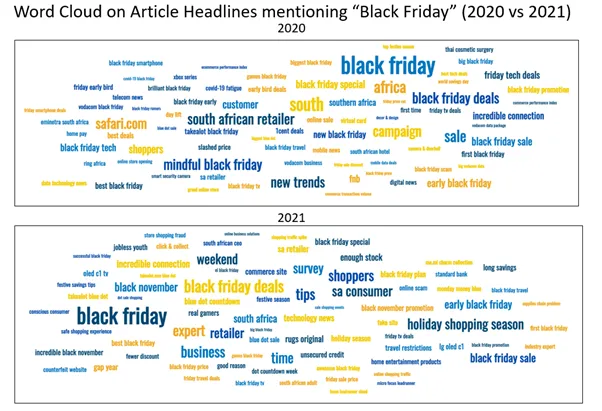

If one compares the word maps of the two years, it is noticeable that in 2020 online retailers were more prominent than this year. There were also words or phrases reflecting the anxiety of 2020 that are absent this year – “mindful Black Friday”, “new trends” and “Covid-19 fatigue”. Even the stock “Black Friday deals” enjoyed more prominence this year than last.

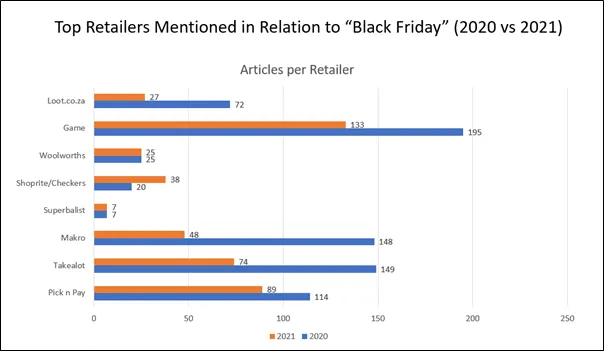

The number of articles about top retailers in the media also shows an interesting pattern, with significant changes between ’20 and ’21. Online retailers Takealot (148 vs 48) and Loot (72 vs 27) show a clear bias toward online shopping last year. Shoprite Checkers, despite its superb early success in online groceries order and motorcycle delivery, had more mentions this year than last (20 vs 38) – albeit off a low base.

South Africans were clearly seeking more value for money for more basic items, with Game (195 vs 133) and Makro (148 vs 48) showing significant changes. Bulletproof Woolies stayed exactly the same (25 vs 25) and Pick n Pay also showed less of a swing (114 vs 89). Wealthier South Africans were less affected, at least around basics, than the less well off.

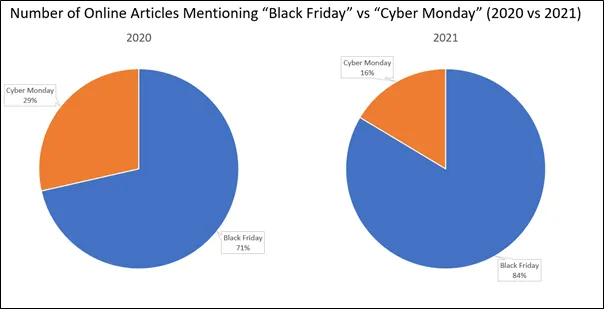

It is also interesting to compare the percentage of articles about Black Friday vs Cyber Monday over the two years. Cyber Monday was bigger (29%) last year than this over the same period (16%). This may indicate a few interesting insights. Firstly, more people were shopping online last year because of reluctance to visit crowded stores. The drop this year may mean people still prefer to shop in person, or that more retailers have added effective online shopping and thus reduced the divide between Black Friday and Cyber Monday, or most likely, a combination of both..

Like working remotely, the pandemic has definitely catapulted online shopping more into the mainstream and it will be interesting to see how this trend will develop. Retailers will see it as an additional business channel and we can expect incremental innovation to iron out the bumps in this way of shopping.

Black Friday has only really been a thing in South Africa since 2012, but in the five years between then and 2017 it grew by nearly 10 000%. It is probably the clearest snapshot of the health of South Africa’s retail industry year on year, and could be seen as a bellwether of the state of the general economy and consumer financial health and confidence.